As high-cost specialty treatments become more common, manufacturers are turning to innovative contracting to boost coverage for their products. Many cell and gene therapies, orphan drugs, and oncology therapies are prohibitively expensive, with costs ranging from several hundred thousand to millions of dollars.

Warranty-based agreements help mitigate the risk of paying for these therapies, as they offer payers financial protection if a patient must stop treatment for clinical reasons. If a therapy fails to work as intended, manufacturers agree to reimburse payers (and sometimes patients) a certain amount of what was initially spent. These agreements are usually in effect for a specified period of time or number of treatments.

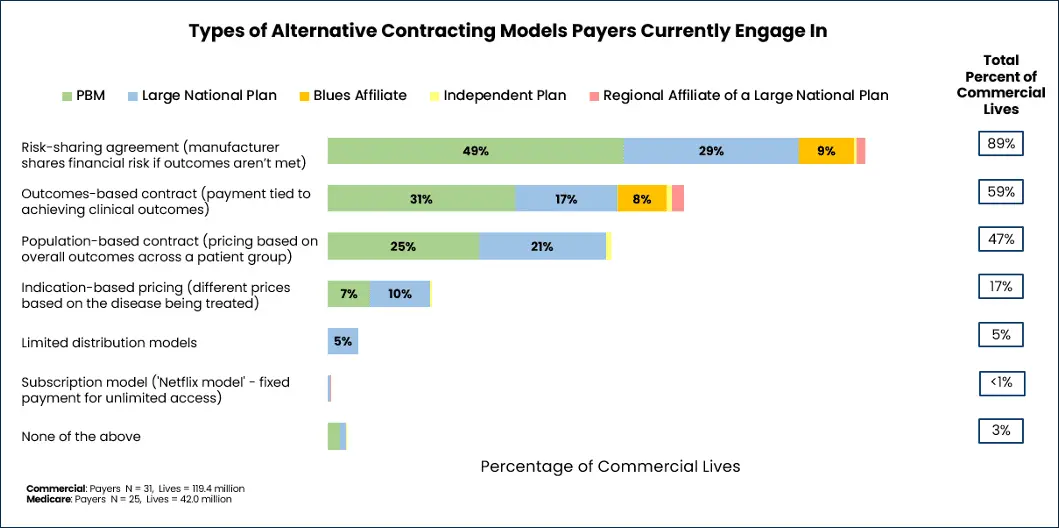

To find out which types of these innovative contacts are most popular with payers, the MMIT Index team conducted primary research with payers and PBMs representing 75% of commercial and managed Medicare lives. First, we found that the vast majority of payers have already entered into various types of alternative contracting models with manufacturers (see below).

While risk-sharing agreements, outcomes-based and population-based contracts are the most common contracting models, there is enormous variety and model overlap in contracting. Consider a pay-for-performance contract, which could be structured either at a population level (payments depend upon meeting aggregated outcomes across a defined patient group) or the individual level (payments are contingent on a specific patient’s progress).

In a hypothetical example of a patient-focused, outcomes-based pay-for-performance contract, for example, a manufacturer and a PBM might agree that the total cost of an oncology drug will be paid in stages: an initial payment up front, followed by additional payments if the patient shows tumor reduction at 3 months and remains progression-free at 6 months. If the patient doesn’t reach those milestones, the later payments are reduced or not made at all.

Prevalent Contract Types Within Rare Disease and Oncology

Much of our research focused on determining which types of agreements are considered the most valuable by payers. Here are the results for the five most common types of warranty-based agreements:

100% money-back guarantee: Payers representing 54% of commercial lives are currently engaging in contracting with 100% money-back guarantees. These contracts typically specify that the payer will receive a full refund if a patient fails to achieve a pre-specified clinical outcome within a stipulated timeframe.

Overall, this is the most common type of warranty-based contract, ranked as “extremely valuable” (4.9 on a 5-point scale) by participants, primarily PBMs and large national plans. Most participating payers have this type of contract within both rare/orphan disease and oncology areas, and prefer them over traditional contracts. One respondent also used money-back guarantee contracts for gene therapies.

Pay-for-performance: The pay-for-performance installment model is the most popular type of warranty-based contract for PBMs in particular; PBMs representing 47% of commercial lives currently have such contracts in place. These contracts tie staggered payments to the patient’s achievement of predetermined clinical milestones.

Approximately half of participating payers have such contracts in oncology, and half in rare/orphan disease. Overall, this type of contract is ranked as very valuable by participating payers (4.6 on a 5-point scale), and is favored slightly more than traditional contracts.

Extended outcome guarantee: Payers representing 50% of commercial lives—primarily PBMs and large national plans, with a few regional plans—have extended outcome contracts in place. Nearly all participating payers have such contracts in rare/orphan disease, while more than half have them in oncology.

These contracts tie reimbursement for a therapy to sustained benefits over a longer monitoring period. If patients do not respond to the medication as expected, the manufacturer must provide a rebate for part of the cost.

More than half of payers (including all PBMs) who engage in extended outcome guarantee contracts find them to be extremely valuable (4.4 on a 5-point scale), and they are preferred more than traditional contracts.

Partial refunds based on outcome tiers: The least common type of warranty-based agreement involves refunds based on the degree of product underperformance. PBMs, large national plans, and Blues affiliates representing 38% of commercial lives have this type of plan in place, mostly in rare/orphan disease.

While most payers who engage in this type of contract find them to be at least somewhat valuable (3.4 on a 5-point scale), they also specify a marked preference for traditional contracts.

Retreatment, or free second dose: Payers representing 39% of commercial lives have at least one retreatment contract in place, which typically offer a free second dose if the patient’s initial dose is unsuccessful. This type of contract is more popular within oncology than rare/orphan disease.

Only one in four participating payers found this type of contract to be very valuable; the mean score was 3.0 on a 5-point scale. Payers representing the majority of covered lives prefer traditional contracting over free second dose or retreatment agreements.

Of course, designing warranty-based contracts that meet the needs of both payers and pharma companies can be a daunting task. According to our research, payers that do not engage in such contracts with manufacturers are most put off by the challenges of building them, followed by the administrative burden of executing them.

To create a mutually beneficial contract, payers must first align with manufacturers on which patient metrics are satisfactory for these agreements. Our research indicates that most payers prefer to be involved in reviewing the proposed outcomes used to measure success, providing feedback through a structured interview process. Once metrics are selected, however, payers may also find tracking patient results over time to be difficult.

While entering into any type of value-based or warranty-centered contract can be a time-consuming process, payers and manufacturers share the ultimate goal of improving patients’ health. With a bit of collaborative teamwork, payers and manufacturers can carefully structure such agreements to mitigate risks for both parties — thereby ensuring that more patients can access these life-saving therapies in the first place.

For insights into payer perspectives on utilization and contracting, learn more about MMIT’s Biologics & Injectables Index.